The Global Financial Integrity study

On December 15 2011, Global Financial Integrity, a US-based watchdog released the “Illicit Financial Flows from Developing Countries over the Decade Ending 2009” study where it estimates that over the decade ending 2009, developing countries around the world lost a massive US$8.44 trillion.

On a local context, Malaysia was placed fifth in the world on cumulative total illicit financial flows (“IFF”) since 2000. For 2009 alone, IFF (non-normalized) amounted to approximately US$46.86billion (approximately RM145billion @ exchange rate of RM3.1 = US$1) and over the cumulative 9 years, total IFF amounted to a massive US$350.47 (approximately RM1,086.46billion). Even on a more conservative estimation of the study, Malaysia has lost US$337.87billion over the same period, which is approximately RM1,047.4billion.

Two methods of estimation were used in the study, one being the World Bank Residual model (using the change in external debt or CED), and secondly, trade mispricing (using the Gross Excluding Reversals method or GER).

Through the balance of payments (a component of CED), it captures unrecorded capital leakages i.e. illicit transfers of the proceeds of bribery, theft, kickbacks, and tax evasion. Meanwhile, outflow of unrecorded transfers due to trade mispricing was captured under the GER method.

Based on the study, Malaysia’s 9-year average normalized i.e. conservative IFF amounted to USD$14.17billion (42%; RM43.9billion) due to CED while GER accounted for $19.62billion (58%; RM60.8billion). Meanwhile, average non-normalized IFF was US$15.43billion (44%; RM47.5billion) due to CED and US$19.62billion (56%; RM60.8billion) due to GER.

Malaysia is the only country where both channels of IFF, CED and GER, are roughly in comparable portions.

Definition of IFF

Under the notes on methodology of the IFF, it detailed out the following:

“Illicit flows involve capital that is illegally earned, transferred, or utilized and covers all unrecorded private financial outflows that drive the accumulation of foreign assets by residents in contravention of applicable capital controls and regulatory frameworks. Hence, illicit flows may involve capital earned through legitimate means such as the profits of a legitimate business. It is the transfer abroad of that profit in violation of applicable laws (such as non-payment of applicable corporate taxes or breaking of exchange control regulations) that makes the outflows illicit.”

A more layman interpretation is IFF involves cross-border movement of money that is illegally earned, transferred, or utilized. IFF generally involve the transfer of money earned through illegal activities such as corruption, transactions involving contraband goods, criminal activities, and efforts to shelter wealth from a country’s tax authorities.

What is in our Malaysian Law?

The Malaysian Transfer Pricing Guidelines (“TP Guidelines”) was introduced in July 2003 by the Malaysian Inland Revenue Board (“MIRB”). The TP Guidelines provides guidance on taxpayers on the application of arm length principle, which is espoused through the anti-avoidance provisions of the Malaysian Income Tax Act 1967 (“MITA”).

With the introduction of the TP Guidelines, specialist group was set up within MIRB to deal with transfer pricing issues. Desk audit and field audits were rigorously carried out since its’ set up.

The statutory law that governs transfer pricing is provided under the anti-avoidance provision in Section 140 of the MITA; where it provides the power to the Director General of Inland Revenue (“DGIR”) to disregard transactions that are deemed not arm’s length and make necessary adjustments to revise or impose additional tax liabilities.

Section 140 has been used widely by the MIRB for local and cross border transactions, adjusting any transfer pricing abuses. The arm’s length definition was not defined in the MITA; however the concept and its application were provided under the TP Guidelines. Under self assessment system, the burden of proof lies with taxpayers to justify such transactions.

The MIRB further introduced a new section, Section 140A, which came into effect on 1 January 2009 that empowers the DGIR to make adjustments on transactions of goods, services or financial assistance between related companies based on the arm’s length principle.

Additionally, all related parties transactions are required to be submitted, under Section N of the Form C, where the categories of related party transactions consists of:

- Total sales to related companies in / outside Malaysia

- Total purchases from related companies in / outside Malaysia

- Other payments to related companies in / outside Malaysia

- Other payments to related companies outside Malaysia

- Loans to related companies in / outside Malaysia

- Borrowings from related companies in / outside Malaysia

- Receipt from related companies in / outside Malaysia

There is no specific provision for non-compliance or not having transfer pricing documentation in place under the TP Guidelines. However, where transfer pricing adjustments are made, any additional taxes resulting from such adjustments will be subjected to additional penalties of as high as 45%.

Multinational companies’ (MNC) transfer pricing the main cause?

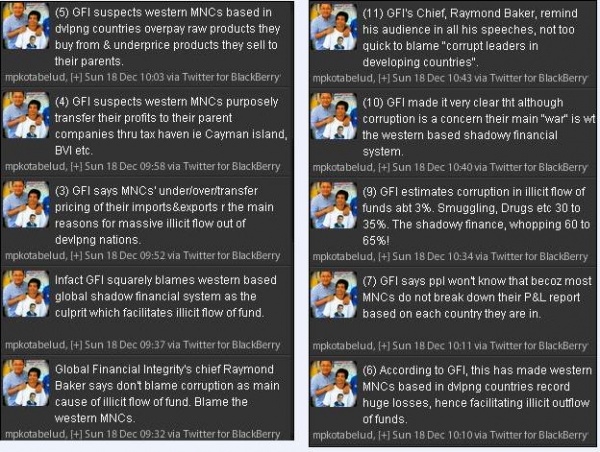

As detailed above, Malaysia has in effect the necessary laws and guidelines in place to deal with transfer pricing and money laundering activities. So it was rather surprising when our learned Kota Belud Member of Parliament (“MP”) suggested that MNCs is largely the cause of such massive amount of IFF, basing on GFI Director Raymond Baker’s speech and certain part of the study.

Perhaps the question to ask is why despite having such laws in place; there is still a massive amount of IFF out of the country. Instead, our learned MP has suggested that MNCs’ under/over transfer pricing under western global financial system is to be blamed and chose to downplay the effect of corruption.

So what is our learned MP trying to imply? Is our learned MP suggesting that the likes of Intel, Agilent, Western Digital, and a whole host of Japanese and other MNCs are involve in transferring IFF? Let’s just not be too quick to point fingers.

Having been in the transfer pricing environment for close to a decade, I must say that transfer pricing has been the one of the most scrutinized subject by the MIRB since the TP Guidelines was introduced, where transfer pricing desk audits and field audits were conducted. Even during routine tax audits, transfer pricing has been one of the hot subjects.

Transfer pricing is not cast in stones. A lot factors are considered to arrive at certain pricing, where different pricing strategies are adopted taking into account both quantitative and qualitative considerations i.e. business strategies, characteristics of services, functions performed, economic conditions. For example, companies may go on a low pricing strategy of certain products, as it is able to recover profitability based on volume (economies of scale). Or it could also be the need to maintain low margin products where profitability can be recovered through high margin products. The numbers do tell a story.

However, having said that, not all are fairy tales. There is no denying that MNCs do get their transfer pricing wrong at times, and from my years of experience, it is rather that companies have got their projections wrong or made a bad business decisions. And in some cases, as a consequence, transfer pricing adjustments running into hundreds of millions in additional taxes were paid. Not to mention, penalties as well.

More likely than not, where there are cases of transfer mispricing, MNCs would always step forward and rectify the situation. This is so because being in the corporate and business environment, getting caught by authorities in such act will most likely cause serious damage to business integrity and reputation. Compliance is one of the most stringent as far as I have seen from a corporate culture perspective, or at least for cases I have seen.

The learned MP also suggested that there were not enough information disclosed by MNCs, hence it is hard to trace IFF due to transfer mispricing. I beg to differ.

There are actually considerable amounts of information disclosed in the Form C for monitoring and triggering transfer pricing or tax audits. In addition to related companies transactions that need to disclosed as explained earlier, companies will also need to disclose details of main shareholders in Part P of the Form C if it is a controlled company. Similarly, the related party transactions and details are disclosed in the notes to Profit and Loss accounts; and disclosure requirements are even more stringent if it is a public listed company.

The learned MP has brought out the point where MNCs were using tax havens as a conduit for the IFF. I do not deny this happening, but based on experience, a lot of MNCs has a strong requirement in terms of substance over form and more often than not, MIRB is able to pick up these structures in the first instance. Let us not forget that our very own Labuan, an international financial centre, is deemed a tax haven by other foreign jurisdictions. It would be interesting to know how much financial transactions flow through Labuan.

Perhaps the question to ask is what is wrong with our current monitoring, enforcement and implementation system that despite having the necessary laws and conducting rigorous audits, there are still such leakages. This is something that our learned MP should look into.

How about local conglomerates and GLCs?

While I have mentioned that MNCs are subjected to more scrutiny on its cross border transactions, the same cannot be said for local conglomerates and government-linked companies (“GLCs”). Based on past experience, local conglomerates and GLCs have not been the main focus of MIRB and I have not seen as much transfer pricing audit being carried out (perhaps this has changed). Mind you local conglomerates and GLCs have a lot of cross border dealings and transactions as well.

Only a few days ago, our Prime Minister announced that an additional RM22billion (US$7billion) of tax is collected for 2011 to plug leakages. Let’s us then theoretically apply the same collection amount to the 2009 figure, taking into account half i.e. 50% is caused by the GER; and it still leaves US$16.43billion (RM50.9billion) unaccounted for. Could all this amount due to transfer mispricing caused by MNCs? How much of this unaccounted amount can be apportioned to local conglomerates and GLCs? Do they also have some form of tax haven structures in place as well? And I have not yet mentioned dealings of the rich and powerful individuals.

This is something I would love to find out and I do agree with the learned MP on this with regards to a more detailed analysis on Malaysia.

So what about CED?

Interestingly, what has not been pointed out by the learned MP is that Malaysia’s IFF was also caused by CED, which relates to illicit transfers of the proceeds of bribery, theft, kickbacks, and tax evasion. It is pointed out in the study that Malaysia is the only country where IFF is caused by a comparable portion of CED and GER.

So what does this mean? It is effectively saying that an IFF totaling US$21.47billion (RM66.6billion) in 2009 alone was due to the activities involving briberies, theft, kickbacks and tax evasions. The comparable size of 50% to transfer mispricing is definitely an alarming cause of concern itself would it not?

It is not known what proportion relates to bribery, theft, kickbacks and tax evasion. So far for tax evasion is concerned, there has not been any reported case where large MNCs were caught in such act, which carries a fine and/or imprisonment with additionally penalty of 300% on amount undercharged. Hence,

And our Inspector General of Police has openly acknowledged that such IFF is not something new and is aware of such leakages. So my question would be what has been done to address this?

This is extremely worrying as there are no accounts or method to track such IFF, as these outflows are not available to public eyes. Instead of trying to just point fingers to the MNCs, I believe efforts should be channeled by the Government to work on addressing these issues. I rest my case.

Adrian Ng is a Transfer Pricing Specialist and has work with multinational companies across various industries ranging from manufacturing, trading, electronics, automotive, property development, construction, power, oil and gas among others.

hishamh of economics Malaysia should read this!

He has been disputing a lot of the GFI's claims, in defense of the BN govt, playing on the ignorance of the masses about economical terms.

Well done, Adrian.

Dear Adrian,

Thank you for the comments. Always a pleasure. And great to know there is someone who is a transfer pricing specialist amongst us here in Malaysia. Maybe GFI should engage you to get better understanding of Malaysia's case.

Some comments from me.

FIrst off, you quoted my tweets. Thanks. Hope you are a follower.

Second, those facts I mentioned in my tweets were not exactly mine. They were GFI's. I just tweeted what I read in the report itself. I guess your response should be directed at GFI as well.

Third, if you care to read the report and GFI's website along with several public speeches on YouTube by Raymond Baker (GFI chief himself}, you would find their arguments that corruption is not the reason do have merit.

GFI has been very consistent in denying that corruption is the main reason for illicit flow of funds from the developing countries (their words not mine).

I believe the reason why they keep on emphasizing that is because, number one it is a fact and number two, to prevent debates about something as serious as trillion dollars illicit flow of fund from becoming political polemic. It is interesting to watch Mr Baker's youtube video speeches because he would invariably state that at the beginning of his speeches to ensure his audience did not quick to accuse the corrupt governments over there in the developing world (his words not mine).

Another point. GFI's Chief Raymond Baker strongly blame the global financial system created by the west (again, his words not mine) for facilitating the massive IFF from developing countries into the western governments coffers . In fact, GFI has been campaigning hard to get support from the developed countries to reform the certain aspects of the global financial system. Countries like Norway are responding. Watch his youtube videos.

Oh ya, despite the CED and GER you mentioned above, you forgot to mention that the conclusion stated by the report on Malaysia is:

"it is difficult to point out the reasons behind this massive illicit capital outflow without carrying out in-depth country case (of Malaysia)."

I rest my case.

Thanks.

Rahman

Note:

For a better understanding of IFF, read also this interesting blog entries in Economics Malaysia on illicit flow of fund. Here's the link: http://econsmalaysia.blogspot.com/2011/12/illicit…

and http://econsmalaysia.blogspot.com/2011/01/illicit…

I also wrote a casual blog entry on this http://mpkotabelud.blogspot.com/2011/12/illicit-o…

Dear YB Kota Belud,

Thanks for your kind comments. Thanks also for the links provided for my further understanding of the IFF and your casual blog [you will note that I've a link on my post above =)].

I see a similar response if not an identical reply here. I do appreciate you are quoting based on GFI, which I've made as well. While I appreciate that, I do believe that an individual of your stature i.e being an elected representative and a Member of Parliament, your opinion does carry some form of weight. Quoting means a simple form of making reference. One does not abstained from the simple form of an implied message to be conveyed as well; which is exactly why one is quoting a reference. Otherwise why bother quoting =)

Similarly, I do appreciate your note on what Mr. Raymond is consistently reiterating and the point on political polemic. Let's us focus back on the issues, where fact remains, our country is the only country in the world to have a comparable size of IFF i.e half trade mispricing and half on bribery, theft, kickbacks and tex evasion. This is where the real concern is.

Perhaps let us move forward on this, which I am more interested in. I do believe ultimately, we both agree that a more detailed study on Malaysia is indeed beneficial to say the least, where it would possibly be able to shed further light on both forms of IFF and potentially assist in closing the gap. Perhaps I would suggest that you assist to kickstart this process by officially requesting/inviting GFI to conduct a more for detailed study. I will be happy to assist where possible.

Alternatively, perhaps let's discuss how PusatRakyatLB can be able assist as well. I am sure we will be able to work something on this and move forward. A short chat would suffice to move things forward. I do hope for a favorable response =)