As a lawyer, it has long fascinated me how corporations can get away with murder. Literally.

When the Macondo well blew up in April 2010, killing 11 people and polluting the Gulf of Mexico, the public screamed blue murder. Pressure was on Obama to find out “who did it” and put Them away. This sent the authorities and investigators into a witch hunt mode.

A sure fire way to make corporations clam up.

BP lawyered up and was clearly gagged from admitting responsibility. This got them into even hotter soup. Tony Hayward could not say I’m sorry. A PR disaster. In the meantime, Macondo was gushing oil. It took 87 days to plug the well.

Hayward was forced to step down and “got his life back”. But he could hardly be charged for manslaughter.

Several investigations followed, including BP’s own led by Mark Bly, its safety head. The US Coastguard convened a Board for a hearing that lasted 6 months. The US Department of Justice (DOJ) got busy compiling evidence.

Two and a half years after the incident, Don Vidrine and Robert Kaluza (BP company men on board the rig) were charged with manslaughter of the 11 men. The case hinged on the final decision made by Don Vidrine to discount pressure test anomalies. Three years later, in December 2015, the charges were dropped.

This was not a case that could be levelled on one or two men.

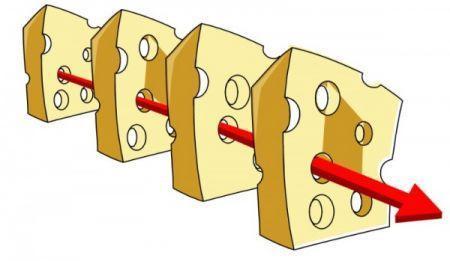

The well blew up due to a series of decisions, each one resulting in the removal of a safety barrier. In the oil and gas industry, we refer to the Swiss Cheese Model.

Each hole in a slice of swiss cheese represents a failure which can result in an accident. A hole is protected by the solid of the next slice, i.e. another safety barrier. The more safety barriers, the better. For as long as the holes don’t line up, you’re safe.

Each hole in a slice of swiss cheese represents a failure which can result in an accident. A hole is protected by the solid of the next slice, i.e. another safety barrier. The more safety barriers, the better. For as long as the holes don’t line up, you’re safe.

Depending on which investigation report you read, as many as 12 safety barriers were breached. No one person is responsible for all barriers. It is a group decision and in this case, not even solely BP’s. Two other players, Halliburton and Transocean were in control of at least two safety barriers: cementing and the BOP (Blow Out Preventer which contains valves to seal off a well) respectively.

The Courts reflected this by apportioning each company’s liability to the public who had suffered loss as a result of the incident. 67% to BP, 30% to Transocean and 3% to Halliburton.

So it would be unfair to penalise Vidrine and Kaluza for the last safety breach while others got away scot free.

The US Coastguard did try. They conducted a thorough investigation. Watching snippets of the hearing I couldn’t help but feel that the Coastguard Board and the numerous lawyers understood well control better than the BP engineers.

The engineers were in a tough spot. As BP employees, they could not say too much which would reveal BP’s culpability or their own. At times, they hesitated to confirm actions that violated BP procedures or wouldn’t admit knowledge of a procedure. They tried to blame the contractors (Transocean and Halliburton) even to the point of incredulity.

A well known interchange between John Guide (engineer within the Well Operations Team and Vidrine’s boss) and US Coastguard Captain Hung Nguyen demonstrates the reluctance to accept accountability in relation to the safety management system of the Deepwater Horizon.

John Guide says, “we had faith that Transocean was attempting to maintain a safe ship”.

As he ends this sentence, Guide grits his teeth and looks at Captain Nguyen, the way a boy looks at his teacher, having just delivered a dog ate my homework line.

Yes, seriously. I watched this video several times. Guide’s body language and choice of words is fascinating.

Captain Nguyen does a double take. “In the Military, we often say, “hope is not a plan”. It appears to me, faith is not a good business decision here.”

Certain themes emerged from the investigations and hearings. BP’s corporate culture was a primary underlying factor. Its engineers were under pressure to cut costs while dealing with a complicated well. Performance and bonus was based on drilling within a set timeframe. Morale was low due to restructuring and lay-offs. Restructuring caused gaps in responsibility and accountability.

Later in the hearing, Captain Nguyen notes, “it seems like everybody’s in charge and at end of the day nobody’s in charge and nobody wants to step up to make a decision here… That’s what I’m seeing.”

Don Vidrine made the final fatal decision. He discounted the anomalies of a pressure test and directed the crew to abandon the well.

The movie Deepwater Horizon focused on that final decision. What the movie did not show was the final call Vidrine made to BP Houston an hour before the blow-out.

Who did Vidrine call? Did that person have the right authority to direct Vidrine? Did Vidrine even take advice? The records reflect contradictory testimonies. Ultimately, the key witnesses, Don Vidrine, Mark Hafle and John Guide took the Fifth Amendment.

If BP was 67% responsible, who do you hold accountable for the deaths of the 11 men? A company can’t go to jail. Who is liable for the acts of a corporation? The CEO? The Board? The shareholders?

Not one person served jail time. BP as a company paid out over $60 billion in penalties and lawsuit settlements.

Don Vidrine pleaded guilty to a misdemeanour under the Clean Water Act. He was fined $50,000 and served 10 months probation. Robert Kaluza claimed trial for the same offence and was acquitted in February 2016.

Tony Hayward resigned on September 30th 2010 replaced by executive director Bob Dudley. Hayward received a £1m payoff and a pension of about half a million pounds a year. He has since held key positions in independent oil companies.

There was very little change at the Board level other than the resignation of Andy Inglis (chief executive of BP E&P) reducing the number of executive directors to three. The Chairman, Carl-Henric Svanber, stayed on.

The shareholders suffered financial loss. By June 2010, share value dropped 48%, though it recovered by December 2010 losing a quarter of its value from the previous year. Shareholders lost three quarters of dividend payments.

At the end of the day, it is the shareholders that demand company performance stretching a company beyond its capabilities and causing its employees to take short cuts. Who are the shareholders? You and me, through our pensions, our mortgages, our bonds and trust funds.

This was first published here.

Thank you for sharing the wonderful post and all the best for your future. I hope to see more post from you. I am satisfied with the arrangement of your Post. You are really a talented person I have ever seen http://www.mcafeecontactnumber.uk/

Great post keep posting and Get Technical support for printers Our expert technicians are available at your service 24*7 providing UN interrupted support we can be contacted via toll-free 8000465071 Epson Printer contact number UK for instant support overall Printer related technical issues if there is any technical query you can visit our website http://www.printerhelpnumbers.co.uk/epson-printer…

What police has been saying about this?

Hello there, just became aware of your site via Google, and discovered that it’s truly useful. I’ll be happy if you continue this in future.

Hotmail Helpline Number

Lenovo Support UK

It was nothing more than an accident and I am pretty sure to say because the reports are saying the same. It was good that there was no life loss on this huge incident.

thanks for sahre this information if you want dell laptop support uk then click here

Avg helpline number

This is my first time to visit here. I found countless interesting

stuff in your weblog, especially in its discussion. I guess I’m not the only one having http://printer-help-me.com/support-for-hp-printer

I like this post.

keep it up….

save and manage the result as sample fax cover sheet an ordinary word processing document. Word processing templates enable the ability to bypass the initial setup and configuration time necessary to create standardized documents such as a resume. simple resignation letter They also enable the automatic configuration of the Attendance Tracking Sheet user interface of the word processing software, with features such as autocompletion, toolbars, thesaurus, and spelling options. Word letter of employment processing templates are ordinarily included as a regular feature in most word processing software. In addition, users of such software often have th option to create and save the